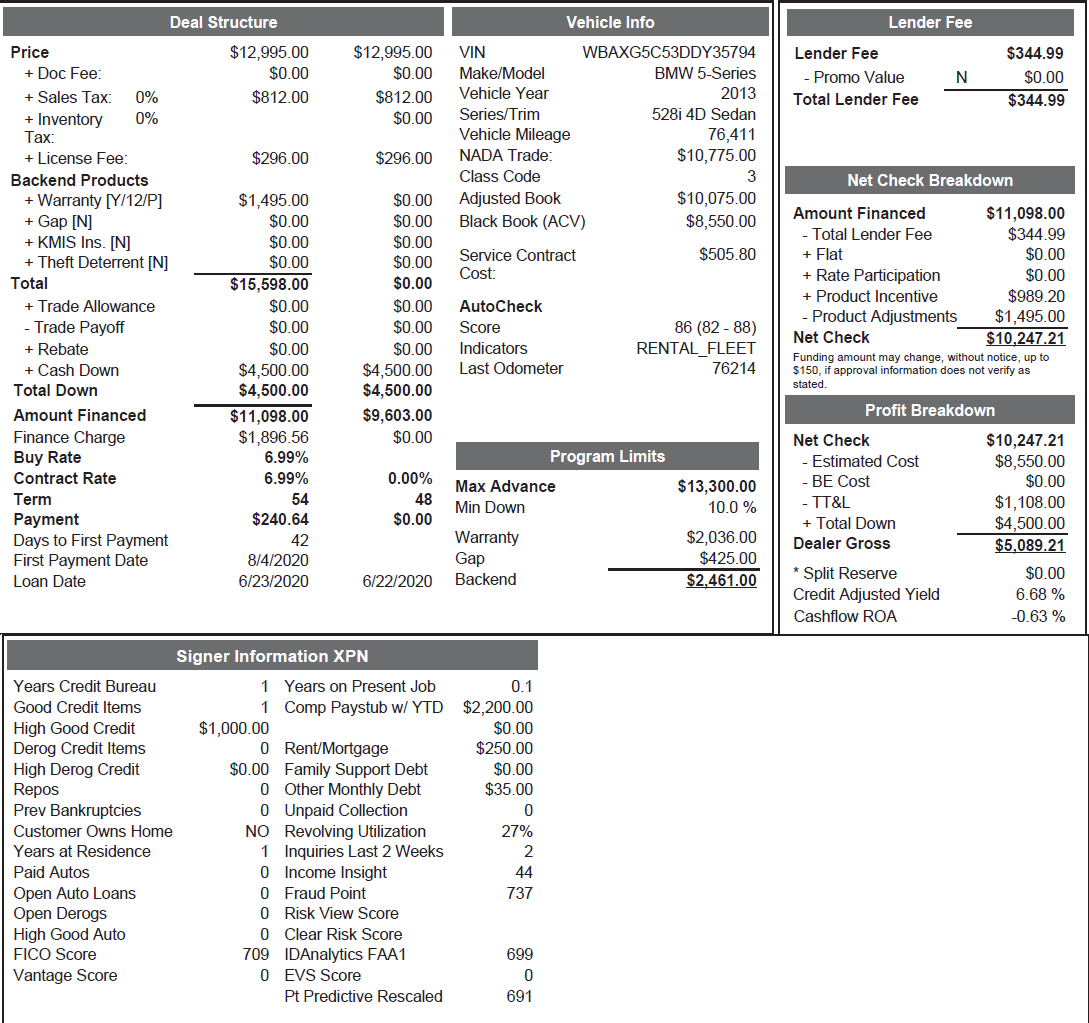

Titanium (750+ Credit Score)

Westlake’s Titanium program allows dealers to provide aggressive financing options to prime customers who walk onto the dealership lot. Dealers enjoy having the ability to offer rates as low as 4.99% with up to 2% dealer participation. Not to mention, dealer fees and down payments can be as low as $0 and terms as high as 72 months. Needless to say, the Titanium program allows Westlake to be a truly competitive full-spectrum lender.

Highlights:

- 4.99% APR

- Down Payments as low as $0

- Up to 2% Dealer Participation

- Up to 72-Month Term

Click to enlarge sample deal

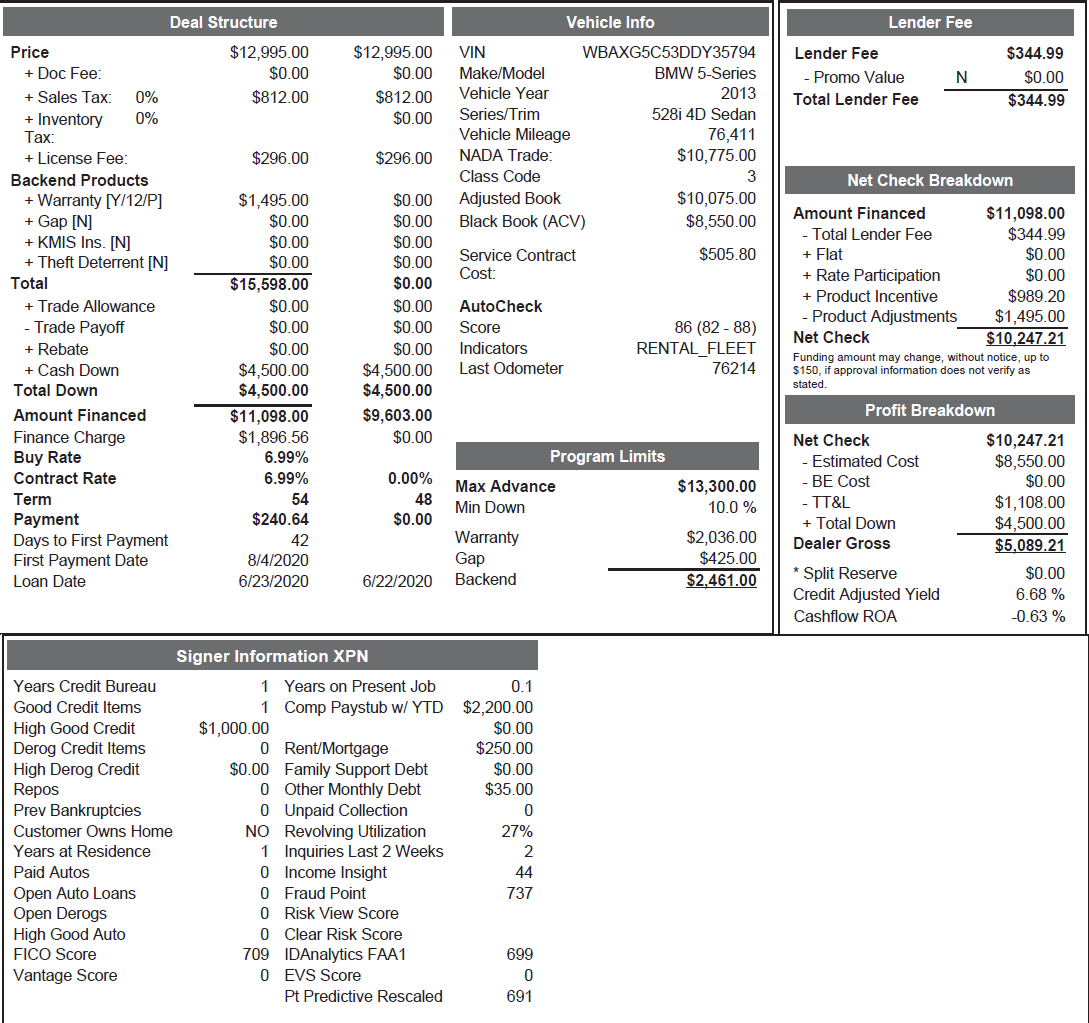

Platinum (700+ Credit Score)

Dealers enjoy the approval flexibility that allows them to cater to a wider range of customers with Westlake’s Platinum program. There is no vehicle mileage restriction, APR’s as low as 9.49% and loan terms up to 72 months with minimal stip requirements. The Platinum program allows dealers to be competitive with the big banks for near-prime and prime credit customers.

Highlights:

- Rates as low as 9.49%

- Up to 2% Dealer Participation

- Minimum Down Payments as low as $0

Click to enlarge sample deal

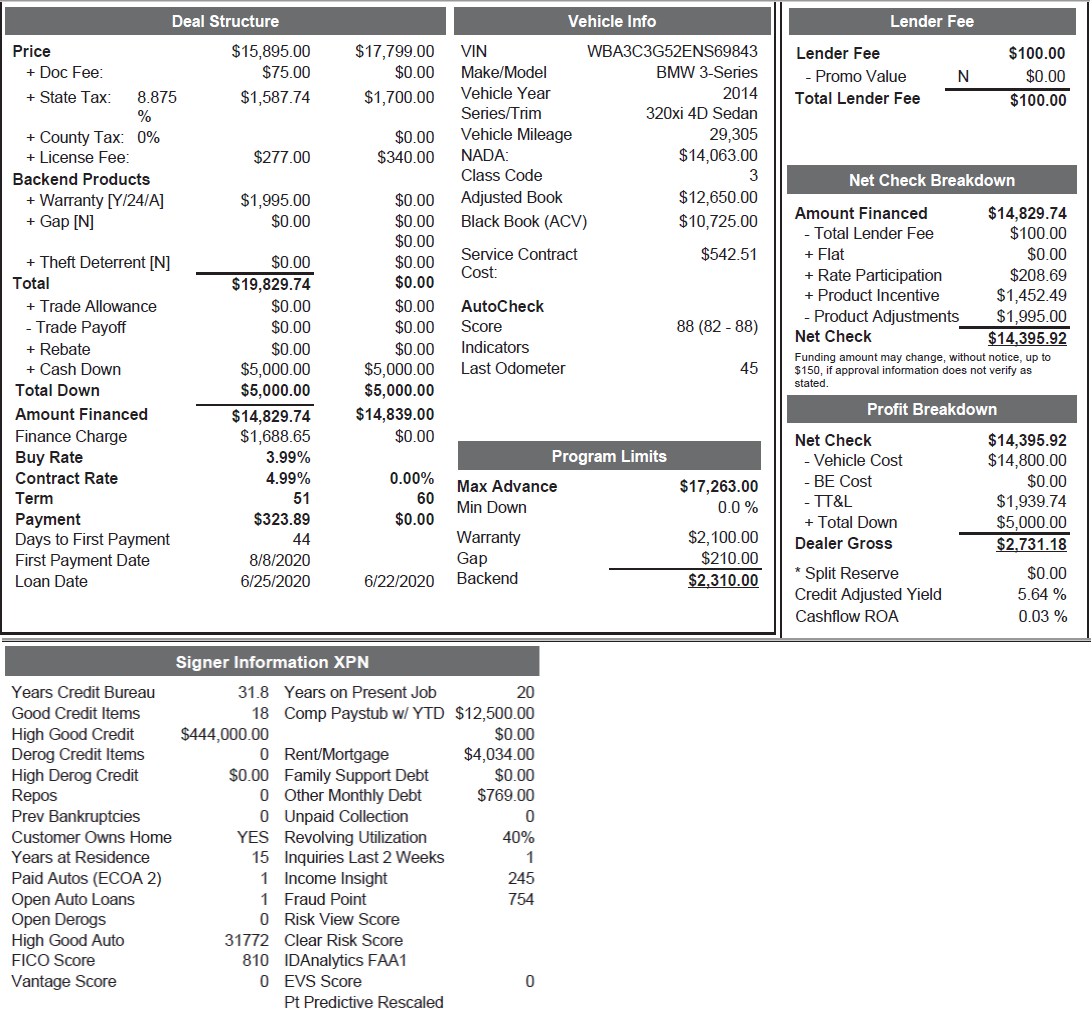

Gold (600-699 Credit Score)

Westlake’s Gold program allows dealers to provide aggressive financing options to customers with established credit history, regardless of vehicle mileage or age. The Gold program offers loan terms up to 72 months, APRs as low as 7.99%, and low dealer fees. Customers with hard-to-prove incomes, open or discharged bankruptcies, and prior non-Westlake repossessions all qualify for the Gold program.

Highlights:

- Rates as low as 7.99%

- Up to 2% Dealer Participation only with no chargebacks

- Loan terms up to 72 Months

- Westlake’s fastest growing segment

Click to enlarge sample deal

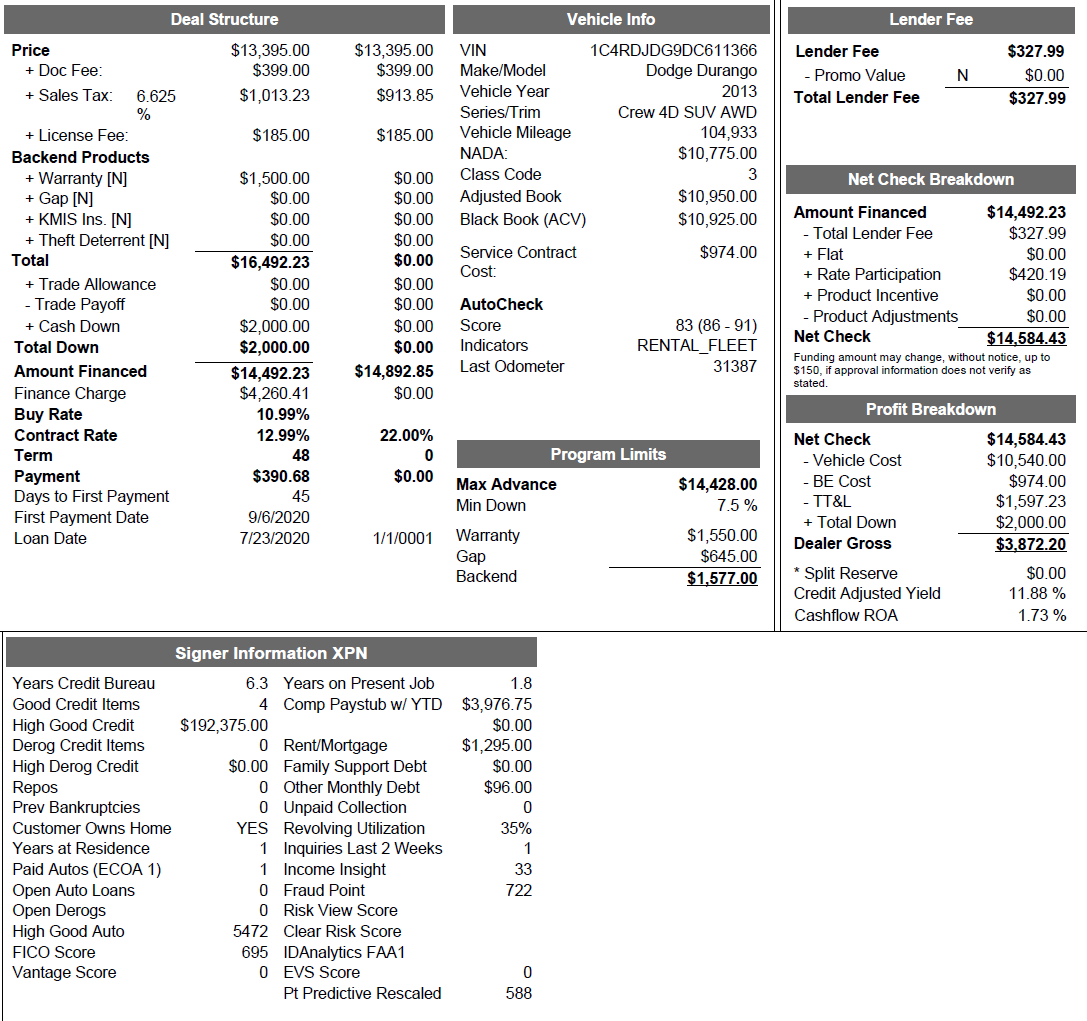

Standard (0-599 Credit Score)

Westlake’s Standard program gives dealers the ability to approve those hard-to-finance customers. Due to the program’s approval flexibility, dealers rely on this program for their first-time buyer and sub-prime finance business. The Standard program does not require a minimum credit score, allows open and past bankruptcies (BK’s), accepts hard-to-prove incomes, and offers competitive Loan to Value (LTVs). Loan terms extend up to 72 months and discounts drop as low as $0. No longer turn away customers due to a lack of financing options.

Highlights:

- No minimum Credit Score

- Loan terms up to 72 months

- Discounts as low as $0

- Accepts hard-to-prove incomes

- Allows open and past bankruptcies (BK’s)

Click to enlarge sample deal